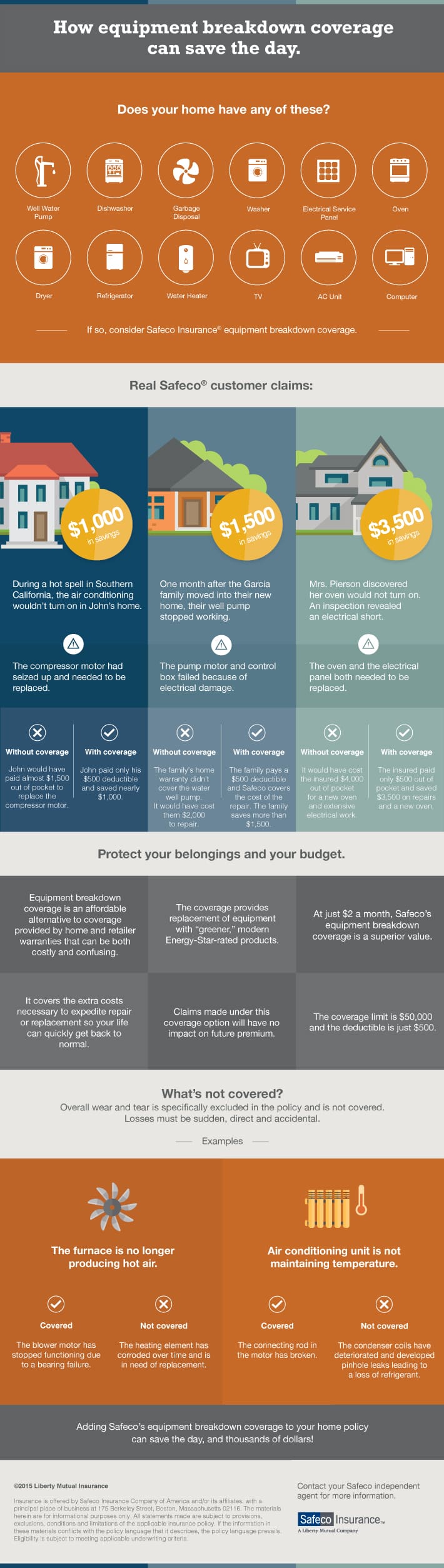

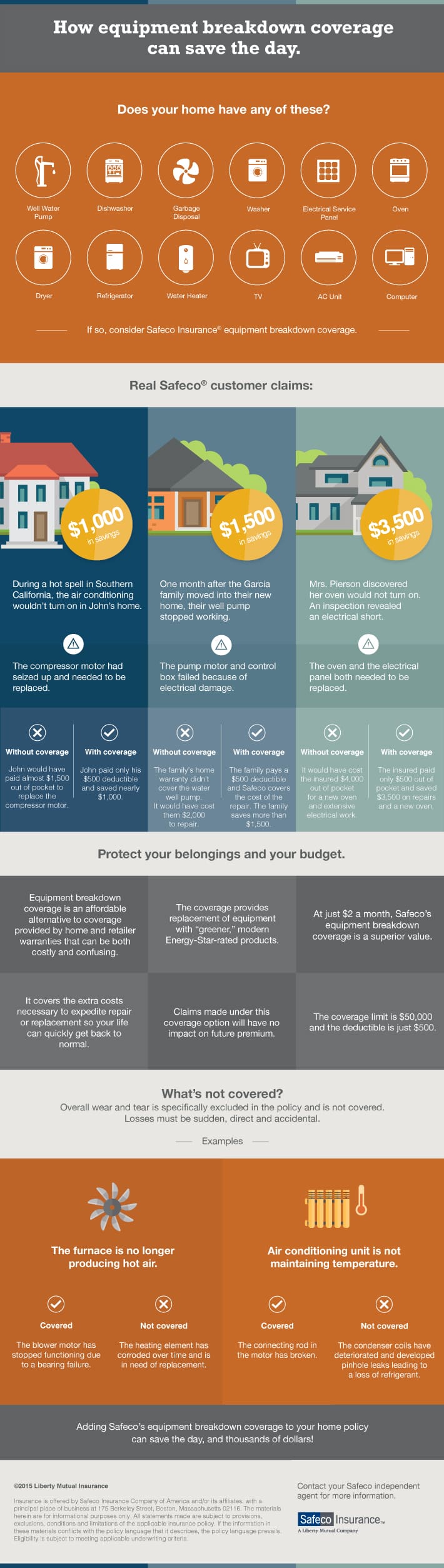

Why Equipment Breakdown Coverage is Worth It

For many of us, paying our insurance premiums every month can feel like, well, a waste of money. If we’re lucky, we don’t actually see our money being put to use — because, the majority of the time, those worst-case catastrophes never happen.

Here’s the thing: insurance doesn’t just protect you from worst-case, life-changing events, it also protects you from that annoying, ugh-why-is-it-happening-to-me-now stuff that can really put a damper on your monthly budget.

Safeco coverage is added to your home insurance policy, and can help cover things like motors/parts to your HVAC unit, electrical issues in your AC and specific home appliance issues. In other words, stuff that can cost you several hundreds or thousands of dollars, but aren’t covered by your homeowner’s policy.

While homeowner’s insurance is great, it doesn’t cover everything — and the better coverage you have, the higher your premium. At a mere $2/month, Equipment Breakdown Coverage from Safeco is less than that latte you got for work this morning!

Read more about it in the infographic below, and call us with any questions!

Source: Safeco Insurance, Real customer claims help explain the value of equipment breakdown coverage.